Sure payroll calculator

Get Started With ADP Payroll. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Payroll Paycheck Calculator Wave

We help you deliver payroll on-time accurately.

. All the features needed for a payroll service are offered. Heres a step-by-step guide to walk you through. Taxes Paid Filed - 100 Guarantee.

Use this calculator to estimate your debt service coverage with a new loan. Discover ADP Payroll Benefits Insurance Time Talent HR More. Special Offer for SurePayroll Customers 2500 off any Virtual TimeClock software license.

Use this calculator to help you determine the cash flow generated by your business. Ad Easy To Run Payroll Get Set Up Running in Minutes. Ad Designed for small business ezPaycheck is easy-to-use and flexible.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. EzPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Find The Best Payroll Software To More Effectively Manage Process Employee Payments.

Ad Easy To Run Payroll Get Set Up Running in Minutes. FREE TRIAL LEARN MORE SurePayroll Virtual TimeClock Special Offer Payroll just got a lot easier. This calculator assumes that all employees are under the maximum FICA tax payment limits.

Most employers use this paycheck calculator to calculate an employees wages for the current payroll period. Ad Welcome to the employee economy. Prior to using a payroll service and trying to.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Ad Compare This Years Top 5 Free Payroll Software. Enter your employees pay information.

Federal Salary Paycheck Calculator. Taxes Paid Filed - 100 Guarantee. Free Unbiased Reviews Top Picks.

Ad Process Payroll Faster Easier With ADP Payroll. It will confirm the deductions you include on your. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

For 2011 FICA OASDI would not be collected on income over 106800 earned by an individual. Ad Join Other Business Owners Whove Made Their Payroll Management Easier. You need a partner with compliance risk expertise.

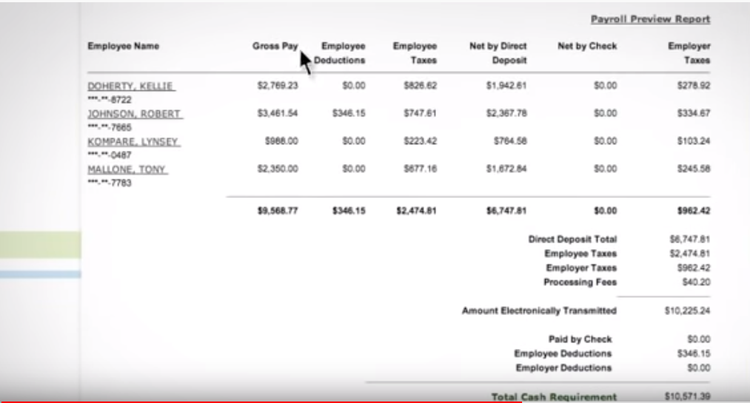

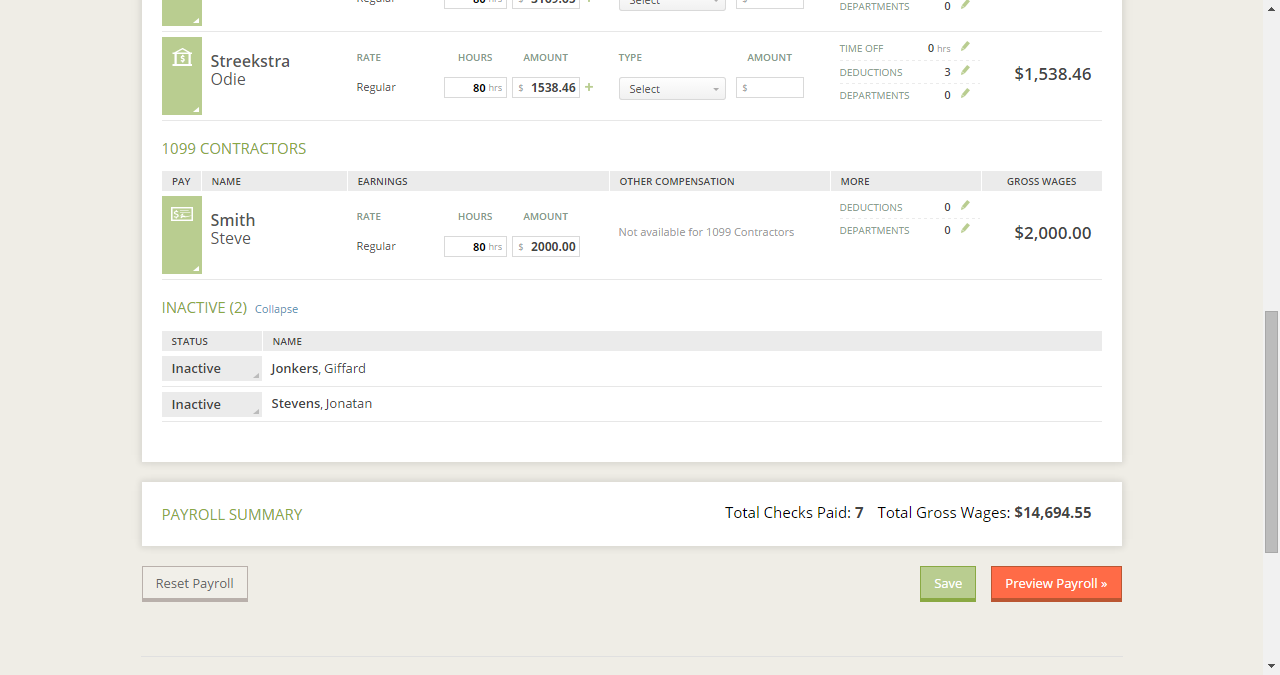

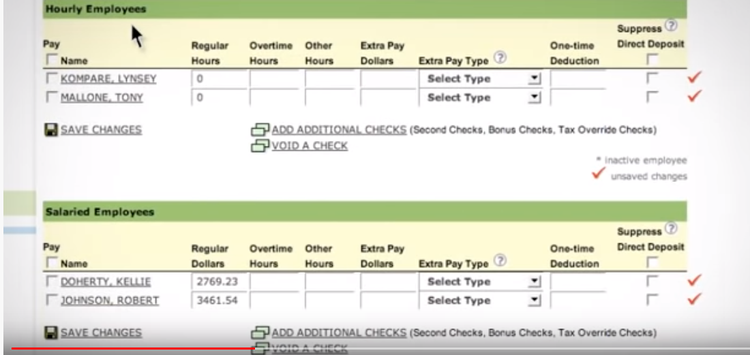

SurePayroll offers a robust system for payroll at an appropriate cost for small businesses. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

How To Calculate Payroll Taxes Methods Examples More

Surepayroll How To Calculate Payroll Taxes Youtube

Surepayroll Review 2022 Pricing Ratings Comparisons

The Best Online Payroll Services For 2022 Pcmag

Free Online Small Business Calculators Surepayroll

Surepayroll Review 2022 Features Pricing More

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Surepayroll Compare 2022 Reviews Pricing Features

Surepayroll Review 2022 Plans Pricing Features Forbes Advisor

Surepayroll Review 2022 Features Pricing More

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Surepayroll Review 2022 Features Pricing More

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

How To Apply Holiday Pay To Payroll 2021 Year End Tips And Tricks Surepayroll Youtube

![]()

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator